How to easily manage electronic invoicing and work contracts? How to meet the needs of dematerialization of invoices?

Reminder: What is electronic invoicing with Chorus Pro?

In accordance with Article 4-I of European Decree No. 2016-1478 on the development of electronic invoicing, the use of electronic invoicing is exclusive of any other method of transmission. An electronic invoice must therefore not be duplicated with the sending of a paper invoice. An invoice is only considered electronic if it has been created, sent and received using a digital tool. Not to be confused with dematerialized invoices, which have been scanned after being printed.

The Chorus Pro Portal is a portal for submitting electronic invoices. It will become progressively mandatory from 2017 to 2020 for companies having commercial relations with public structures (B2G). Construction and public works companies that deal with the State, local authorities and national public institutions are therefore the first to be affected. Since last year, they must all use the electronic invoice. The use of the platform allows to manage exchanges between companies, prime contractors and public authorities. Chorus Pro has a directory of companies to easily distribute invoices between professionals. The platform also allows you to enter and consult electronic invoices and associated statuses.

eProject in all this?

Although Chorus Pro is suitable for standard invoices, managing work invoices on the platform is becoming tricky. Indeed, a work situation may involve several companies, contractors, co-contractors and subcontractors, and give rise to several invoices that are, by nature, closely linked. How can you manage a company’s invoices if you do not know, at the same time, the invoices of its co-contractors and subcontractors? Contract management platforms, such as eProject, have the mission of managing contract payments, including the preparation of situations. Used in addition to Chorus Pro, it guarantees the proper execution of work payment in compliance with the contracting code.

Electronic invoicing extended to all companies

By January 1, 2023, all companies in France must be able to receive electronic invoices. And, from 2023 to 2025, all B2B companies will have to issue only electronic invoices. Thus, the large structures will start, followed by the ETI, then the SMEs and VSEs.

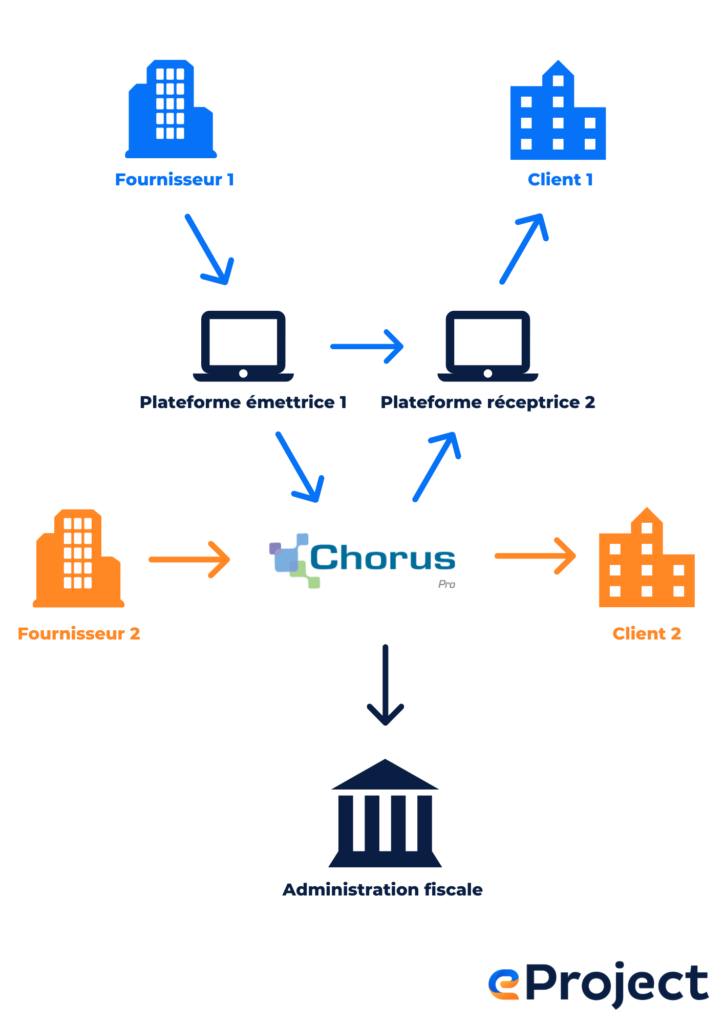

The government has decided for the moment to stay on a so-called Y model to facilitate the transition for companies and avoid too many changes. Indeed, some companies already use third-party platforms for their invoicing. The transmission of invoices and data will therefore be able to be done via these certified platforms (path 1), or via Chorus directly (path 2).

B2C companies will not be obliged to use electronic invoicing for the time being. However, all companies subject to VAT will have to submit to e-reporting and transmit their accounting data to the tax authorities.

This new regulation is part of the European Directive 2014/55, which aims to generalize the use of electronic invoicing for all member countries of the European Union. France is ahead of other European countries, behind Portugal and Italy.

Why use electronic invoicing?

The first objective of this new regulation is to fight against VAT fraud. Every year, it is a loss of revenue estimated at about 140 billion euros for the European Union, called the “VAT Gap“. The public portal Chorus Pro (or authorized private platforms) will automate and facilitate the control and calculation of taxes. With 100% of invoices exchanged via the platforms, it will be difficult for companies to commit fraud.

This digitalization will also improve the competitiveness and the level of service of BtoB companies. An electronic invoice costs 1 euro, compared to 10 euros for a paper invoice. Thanks to a centralized exchange platform, the accounting information will be unique and up-to-date. This will save space, time and money for companies.

The dematerialization of documents optimizes management and improves the productivity of professional teams. Going digital will reduce administrative procedures, facilitate declarations (pre-filling) and reduce errors.

Finally, with invoicing and e-reporting, the tax authorities intend to better control economic activity. Commercial relations will thus be more reliable, secured, traced and closely monitored to improve the reliability of data. The government will be able to better adapt its economic and fiscal policy according to the data collected.

We can add to this list of advantages the reduction of the environmental impact with a great reduction of paper.

The usefulness of a contract management platform

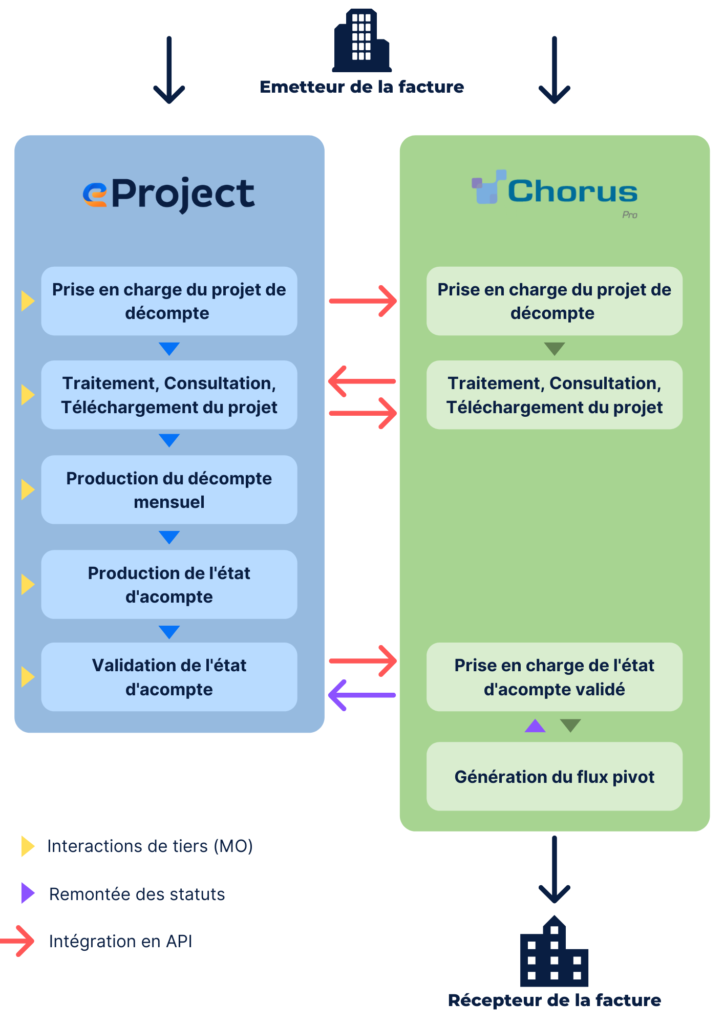

The mission of eProject is to manage work situations that involve several invoices with strong interactions from different stakeholders: contractors, subcontractors, co-contractors. The use of the platform allows the description of contracts and the calculation of work situations. eProject performs the complex calculations of work situations and also ensures the validation of services rendered. Indeed, without detailed knowledge of the associated contracts, the management of work invoices is very complex.

The missions of the eProject and Chorus Pro platforms are therefore complementary. To facilitate their joint use, the API integration allows a strong interaction between the platforms and a single interface for all stakeholders. eProject becomes the entry point to Chorus. Together, they can enable a dematerialization of the accounting chain, from the company to the community, with simplicity and efficiency with a system that allows each stakeholder to intervene on the work situation.

In a nutshell

To summarize, any company subject to VAT and having B2B relations will have to use electronic invoices exclusively from 2023 onwards, depending on its size. Other VAT-registered companies will not be obliged to issue electronic invoices, but will have to carry out e-reporting to the tax authorities. Electronic invoicing and e-reporting will be carried out via a public platform such as Chorus Pro, or via private platforms certified by the Government.

The implementation of this system will require a little bit of planning, especially for small companies. However, it has many advantages and will optimize the financial management of many companies. The reduction of errors and disputes will save time and money.

To manage your work invoices, we recommend that you adopt a contract management software. Indeed, a platform such as eProject ensures the processing of interactions between the invoices of the parties involved. It is therefore the ideal solution for interfacing with Chorus Pro in your dematerialized financial management, from the company to the project owner.